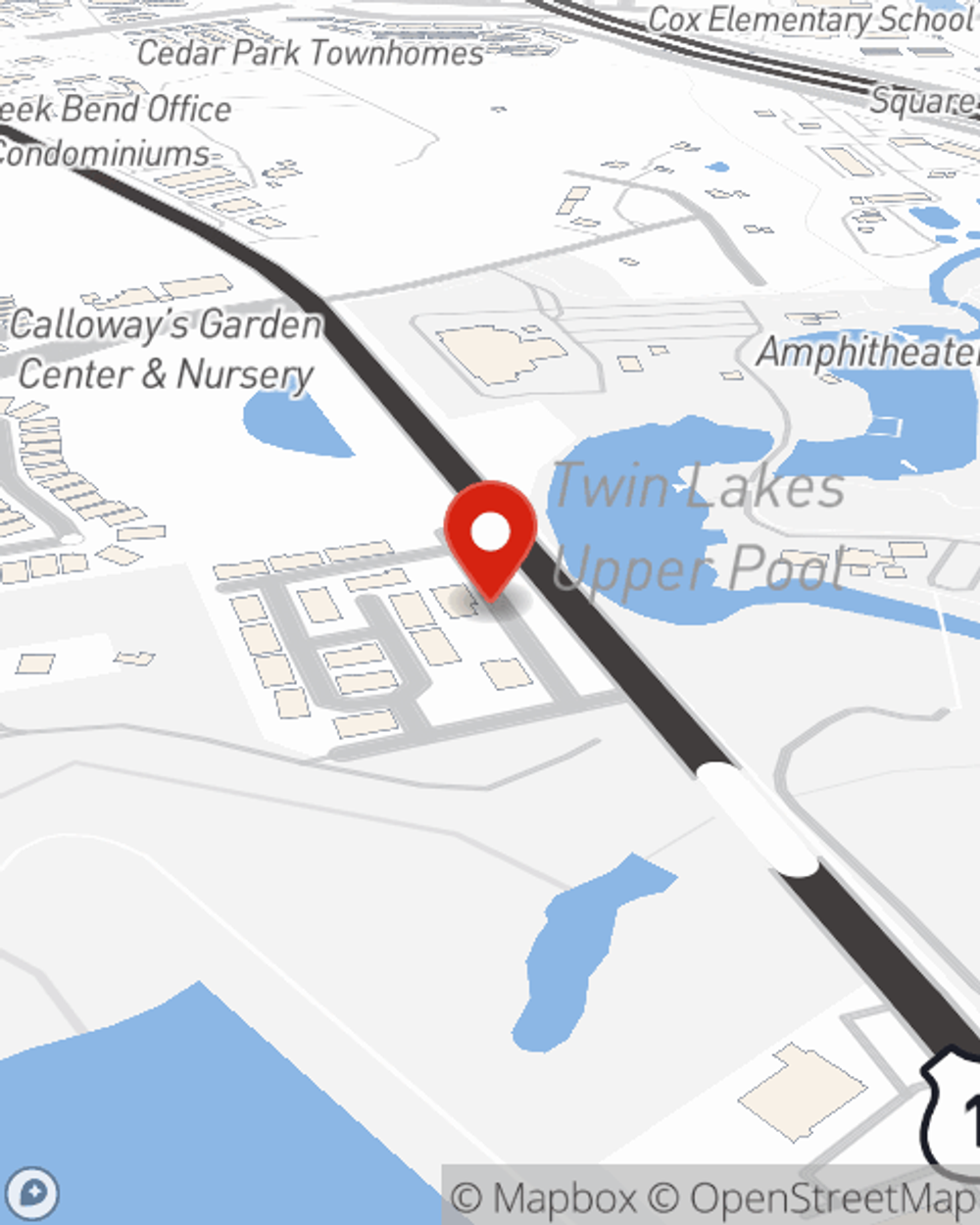

Life Insurance in and around Cedar Park

Insurance that helps life's moments move on

Life happens. Don't wait.

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

Do you know what funerals cost these days? Most people aren't aware that the mean cost of a funeral in America is $8,500. That’s a heavy burden to carry when they are grieving a loss. If your family cannot manage that expense, they may fall on hard times after your passing. With a life insurance policy from State Farm, your family can survive, even without your income. Whether it keeps paying for your home, pays for college or pays off debts, the life insurance you choose can be there when it’s needed most by your loved ones.

Insurance that helps life's moments move on

Life happens. Don't wait.

Agent Lisa Reed, At Your Service

You’ll get that and more with State Farm life insurance. State Farm has outstanding protection plans to keep your family members safe with a policy that’s modified to align with your specific needs. Fortunately you won’t have to figure that out by yourself. With empathy and fantastic customer service, State Farm Agent Lisa Reed walks you through every step to set you up with a plan that guards your loved ones and everything you’ve planned for them.

Simply call or email State Farm agent Lisa Reed's office today to check out how a State Farm policy can help protect your loved ones.

Have More Questions About Life Insurance?

Call Lisa at (512) 331-0009 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

Simple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®